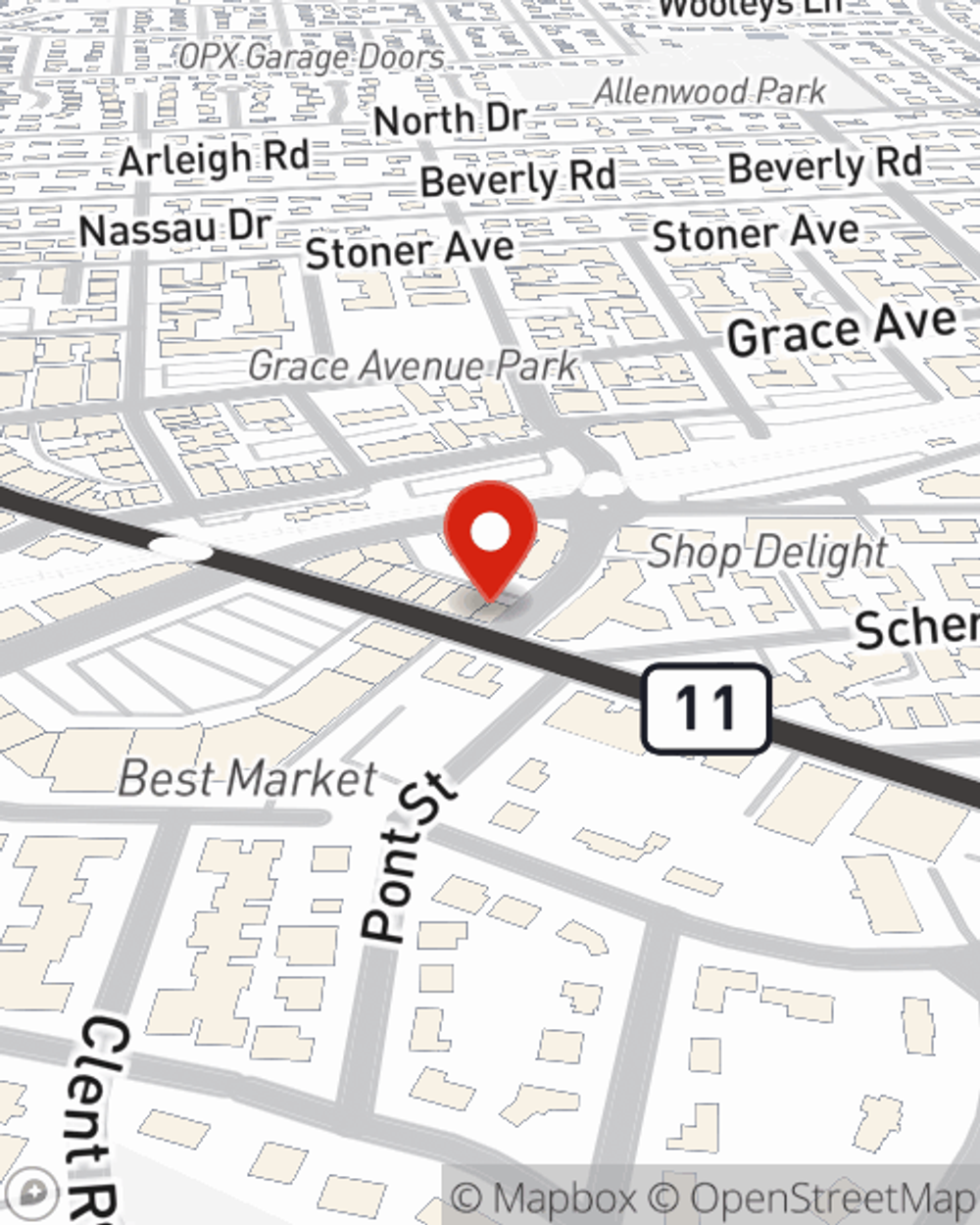

Business Insurance in and around Great Neck

Searching for protection for your business? Look no further than State Farm agent J.R. Orenstein!

Insure your business, intentionally

Cost Effective Insurance For Your Business.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent J.R. Orenstein knows what it's like to put in the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to explore.

Searching for protection for your business? Look no further than State Farm agent J.R. Orenstein!

Insure your business, intentionally

Customizable Coverage For Your Business

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a pharmacist or a podiatrist or you own a shoe repair shop or a travel agency. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent J.R. Orenstein. J.R. Orenstein is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

Call or email the wonderful team at agent J.R. Orenstein's office to learn more about the options that may be right for you and your small business.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

J.R. Orenstein

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.